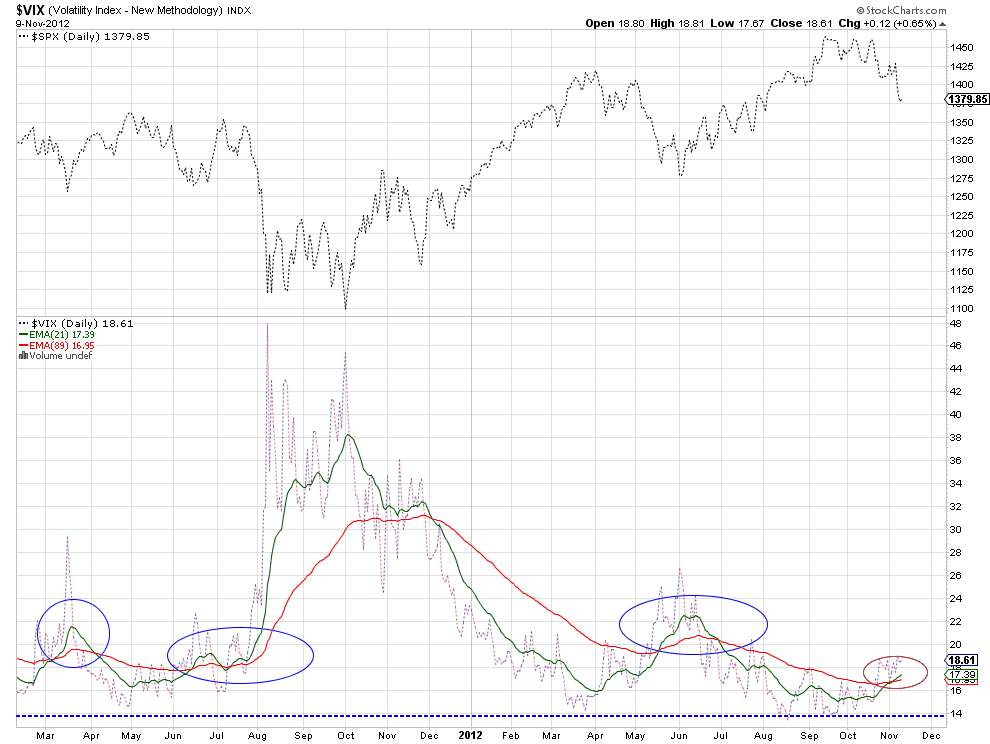

It was widely expected that the removal of uncertainity after the presidential elections will move the $VIX sharply down. After the elections, $VIX didn't fall. $VIX has been very stubborn, in fact. The results of the elections met with market sell off. $VIX has been building a good base around the 14 - 15 area. Everytime $VIX made to that area, it rebounded upwards. Though $VIX hasn't moved much upwards, the key moving averages are crossed over making life further difficult for the risk-on market investing. I am using a short term moving average, 21 EMA and a long term moving average 89 EMA in this case. I have circled previous areas of 21 EMA crossing 89 EMA up. In those instances, results were not encouraging for the broad market. I would wait for the cross down of the same moving averages to put money to risk again. The market is there in the long run, we don't have to participate in the market every single day to make money in the long run. My suggestion is to stay in cash until the next opportunity comes our way. The chart is useful for intermediate term investors.

No comments:

Post a Comment