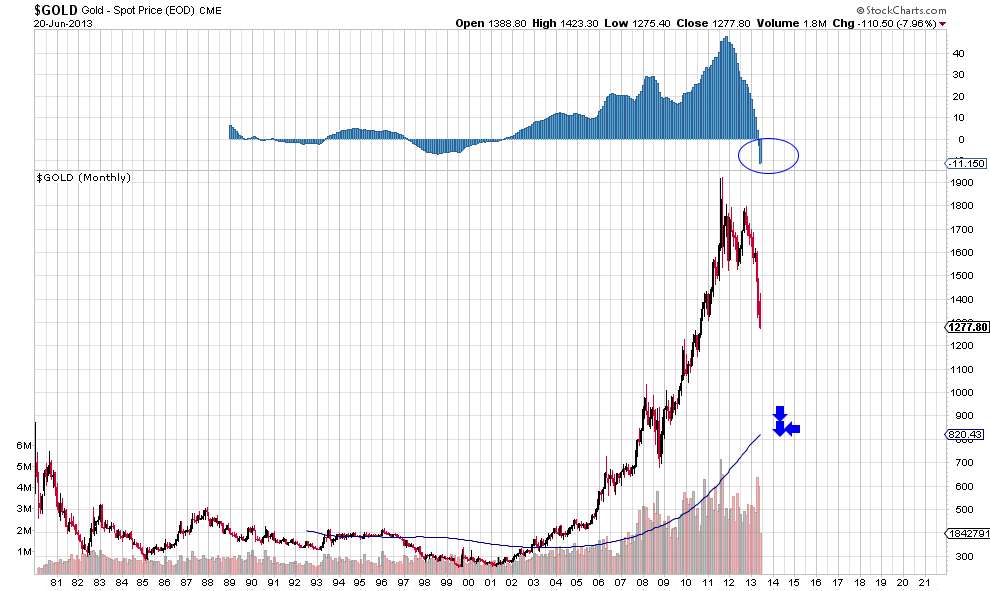

I am guessing 1200s should hold for a while. Knowing the "Spiking slow and falling hard" theory, I wouldn't be surprised if 1200 breaks down. And I know you don't mind, because you stood staring (without selling any of your metal) all the way up and you will do so on the way down as well. To be honest, I planned to sell some of my ornamental gold above 2,000$. But, it never came. See, I had a plan. So did many others who held gold coins. I never had any "gold coins" but just ornaments and paper Gold. I trade paper Gold on a regular basis but the ornaments' sale never fulfilled. I will have to wait till the next big cycle. Well, I won't live that long, so no worries anyway. When Gold dipped below 1600, many people said it was just the beginning (of the bull market), so let's buy more. It turned out to be the beginning, but of the bear market. Chart below shows that, read the circle.

My indicator tells me that we are in the beginning of a bear market, with the 1st tick below 0 occurring in May 2013. Many pundits define a bear market as a price below 20% off the highs, so my indicator does satisfy that technical definition too. For the good of the bulls, I hope the parabolic rise holds, I want to see atleast a touch of 1500$ from below. But, seriously, if I have to be honest, I see a meeting with the blue line in the next 12 months at 900 - 1000$ price. If Gold price waits that long, that is. Because somebody wants to see Gold lower sooner and in a hurry.....

Please help me by copying the message "ditto" to silver traders as well.

No comments:

Post a Comment